We obtain our property insurance in conjunction with Gould Investors and its affiliates and in 2014, we reimbursed Gould $400,000 for our proportionate share of the insurance premiums. We believe that we secure more favorable rates by obtaining property insurance on such basis.

During 2011, $603,0002014, we sold to Gould Investors, 37,081 shares of BRT Realty Trust, a related party, for proceeds of $266,000 (based on the average of the closing prices for the 30 days preceding the sale).

During 2014, $1,045,000 of non-cash compensation expense (relating to the restricted stock and RSU'sRSUs held by our part-time executive officers and employees who are also compensated by Majestic or its affiliates), was charged to our operations. See “Executive Compensation-Compensation Discussion and Analysis-Background”.

Policies and Procedures

Any transaction with affiliated entities raises the potential that we may not receive terms as favorable as those that we would receive if the transactions were entered into with unaffiliated entities or that our officers might otherwise seek benefits for affiliated entities at our expense. Our amended and restated code of business conduct and ethics incontains specific requirements with respect to the "Conflictsapproval of Interest" section, provides that we may enter intothese transactions. Generally, a contract or transaction with an affiliated entity provided that any such transaction ismust be approved by our audit committee which is satisfied that the fees, charges and other payments made to the affiliated entities are reasonable considering all circumstances.

Table of Contents

If a related party transaction is entered into, our audit committee is advised of such transaction and reviews the facts of the transaction and either approves or disapproves the transaction. If a transaction relates to a member of our audit committee, such member will not participate in the audit committee's deliberations. If our audit committee approves or ratifies a related party transaction, it will present the facts of the transaction to our board of directors and recommend that our board of directors approve or ratify such related party transaction. The effect of any such transaction on the independence of any independent director must also be reviewed. Our board of directors then reviews the transaction and a majority of our board of directors, including a majority of our independent directors must approve/ratify or disapprove such related party transaction. If a transaction relates to a memberafter consideration of our board of directors, such member will not participate in the board's deliberations.all relevant factors.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and directors, and persons who beneficially own more than 10% of our issued and outstanding capital stock, file certain reports with the Securities and Exchange Commission. Executive officers, directors and greater than 10% beneficial owners are required by the rules and regulations promulgated by the SEC to furnish us with copies of all Section 16(a) forms they file.

Based on a review of information supplied to us by our executive officers and directors, and public filings made by any 10% beneficial owners, we believe that in 2014 all Section 16(a) filing requirements applicable to our executive officers, directors and 10% beneficial owners with respect to 2011 were met other than with respect to Eugene I. Zuriff, who filed one report with respect to one transaction one day late.on a timely basis.

ADDITIONAL INFORMATION

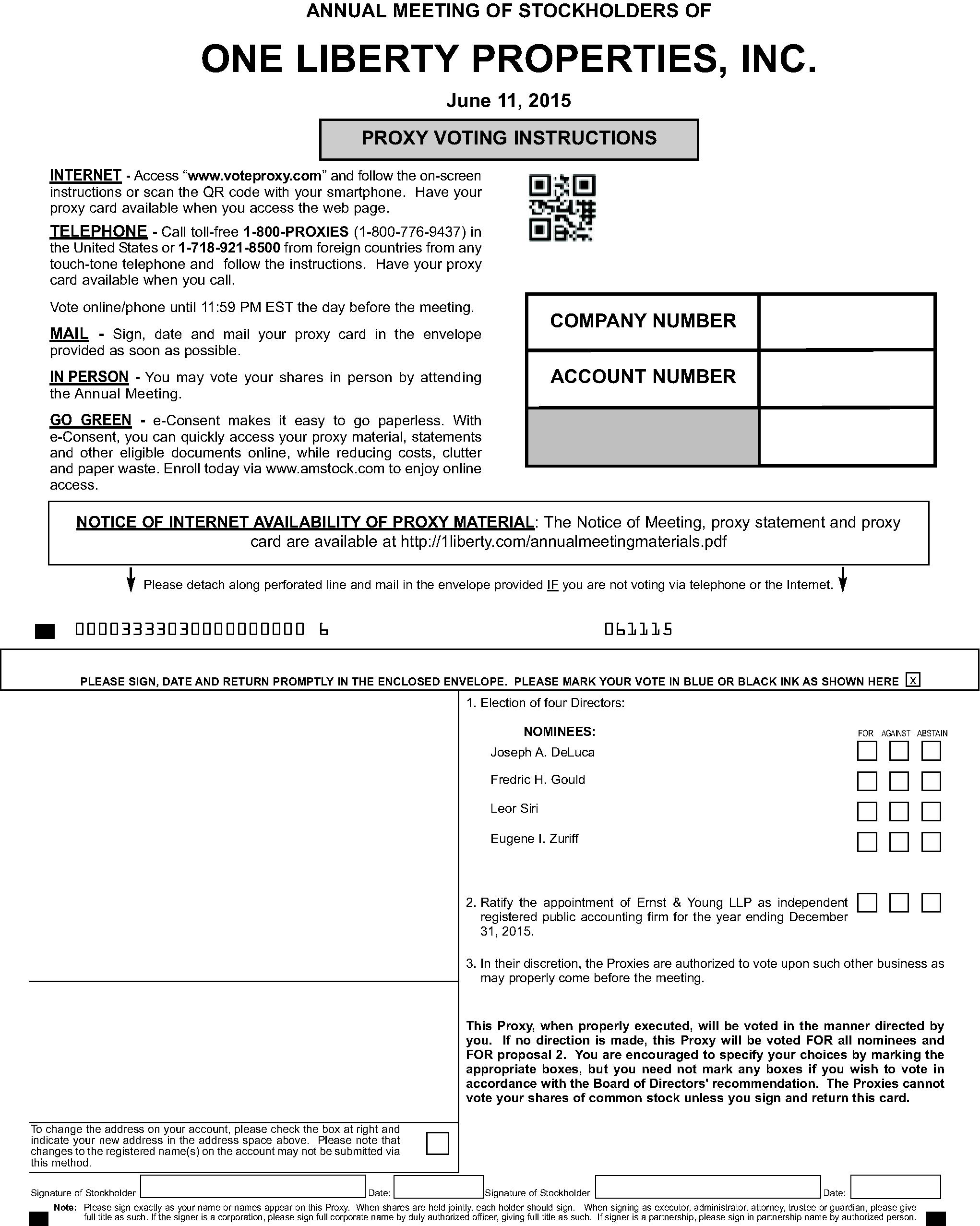

AND NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

As of the date of this proxy statement, we do not know of any business that will be presented for consideration at the meeting other than the items referred to in the Notice of the Meeting. IfSubject to applicable law, if any other matter is properly brought before the meeting for action by stockholders, the holders of the proxies will vote and act with respect to the business in accordance with their best judgment. Discretionaryjudgment and discretionary authority to do so is conferred by the enclosed proxy.

Our corporate governance guidelines, code of business conduct and ethics and the charter for each of our audit, compensation and nominating committees are available at the corporate governance section of our website at: www.onelibertyproperties.com/corporate_governance. Copies of such documents may be obtained without charge by writing to us at 60 Cutter Mill Road, Suite 303, Great Neck, NY 11021, Att: Secretary.

This proxy statement (including the notice of meeting), the proxy card and our 2014 annual report to stockholders are available at http://1liberty.com/annualmeetingmaterials.pdf.

| | |

Great Neck, NY

April 17, 20122015 |

|

By order of the Board of Directors

Mark H. Lundy, Secretary

|

ONE LIBERTY PROPERTIES, INC.

2012 INCENTIVE PLAN

SECTION 1

EFFECTIVE DATE AND PURPOSE

1.1 Effective Date. This Plan shall become effective upon approval by the stockholders of the Company (as defined).

1.2 Purpose of the Plan. The Plan is designed to motivate, retain and attract employees, officers and directors of experience and ability and to further the financial success of the Company by aligning the interests of Participants through the ownership of Shares with the interests of the Company's stockholders.

SECTION 2

DEFINITIONS

The following terms shall have the following meanings (whether used in the singular or plural) unless a different meaning is plainly required by the context:

"1934 Act" means the Securities Exchange Act of 1934, as amended. Reference to a specific section of the 1934 Act or a regulation thereunder shall include any regulation promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.

"Award" means, individually or collectively, a grant under the Plan of Nonqualified Stock Options, Incentive Stock Options, Restricted Stock, Restricted Stock Units and Performance Share Awards.

"Award Agreement" means either (1) the written agreement setting forth the terms and provisions applicable to each Award granted under the Plan or (2) a statement (including an electronic communication) issued by the Company to a Participant describing the terms and provisions of such Award.

"Board" or "Board of Directors" means the Board of Directors of the Company.

"Code" means the Internal Revenue Code of 1986, as amended from time to time, and the regulations thereunder.

"Committee" means the Compensation Committee of the Board or the committee of the Board appointed to administer the Plan.

"Company" means One Liberty Properties, Inc., a Maryland corporation, and any successor thereto.

"Disability" or "Disabled" means the inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.

"Exercise Price" means the price at which a Share may be purchased by a Participant pursuant to the exercise of an Option.

"Fair Market Value" means, as of any given date, (i) the closing sales price of the Shares on any national securities exchange on which the Shares are listed; (ii) the closing sales price if the Shares are listed on the OTCBB or other over the counter market; or (iii) if there is no regular public trading market for such Shares, the fair market value of the Shares as determined by the Committee.

"Grant Date" means, with respect to an Award, the effective date that such Award is granted to a Participant.

"Incentive Stock Option" means an Option to purchase Shares which is designated as an Incentive Stock Option and is intended to meet the requirements of Section 422 of the Code.

"Nonqualified Stock Option" means an Option to purchase Shares which is not an Incentive Stock Option.

"Option" means an Incentive Stock Option or a Nonqualified Stock Option.

"Participant" means an officer, employee, director or consultant of the Company who has been granted an Award under the Plan.

"Performance-Based Award" means any Restricted Stock Award, Restricted Stock Unit, Option or Performance Share Award granted to a Participant that qualifies as "performance based compensation" under Section 162(m) of the Code.

"Performance Criteria" shall mean any or a combination of the following: revenue, earnings, stock price, cash flows, costs, return on equity, stockholders' equity (book value), total equity, asset growth, net operating income, average occupancy, year-end occupancy, funds from operations, adjusted funds from operations, cash available for distribution, total shareholder return, return on assets, or goals relating to acquisitions or divestitures. Performance Criteria need not be the same with respect to all Participants and may be established separately for the Company as a whole, or on a per share basis, and may be based on absolute performance or performance compared to performance by businesses specified by the Committee, and may be based upon performance compared to periods determined by the Committee. All calculations and financial accounting matters relevant to this Plan shall be determined in accordance with GAAP, except as otherwise directed by the Committee.

"Performance Cycle" means one or more periods of time which may be of varying and overlapping durations, as the Committee may select, over which the attainment of one or more Performance Goals will be measured for the purpose of determining a Participants right to and the payment of a Restricted Stock Award, Restricted Stock Unit, Option or Performance Share Award. Each such period shall not be less than twelve months.

"Performance Goals" means for a Performance Cycle, the specific goals established by the Committee for a Performance Cycle based upon the Performance Criteria.

"Period of Restriction" means the period during which an Award granted hereunder is subject to a substantial risk of forfeiture. Such restrictions may be based on the passage of time, the achievement of Performance Goals, the occurrence of other events as determined by the Committee or any one or more of the foregoing.

"Plan" means the One Liberty Property's 2012 Incentive Plan, as set forth herein and as after amended from time to time.

"Restricted Stock" means an Award of Shares, the grant, issuance, retention and/or vesting of which is subject to such conditions as are expressed in the Award Agreement and as contemplated herein.

"Restricted Stock Unit" or"RSU" means an Award of a right to receive one Share, the grant, issuance, retention and/or vesting of which is subject to such conditions as are expressed in the Award Agreement and as contemplated herein.

"Retirement" means (i) a director who has attained the age of 65 years who resigns or retires from the Board or does not stand for re-election to the Board and has served continuously as a Company of the Company for not less than six consecutive years, and (ii) an officer or employee of the Company who has attained the age of 65 years who resigns or retires from the Company or one of its Subsidiaries and has served as an officer and/or employee of the Company or one of its Subsidiaries for not less than ten consecutive years at the time of retirement or resignation, provided that such Participant has not (A) become employed by, or serve as a consultant for, a competitor of the

Company, or (B) acted in a manner during the period of his relationship with the Company or any of its Subsidiaries which has been harmful to the business or reputation of the Company. A determination as to whether a "retiree" or "resignee" has behaved in a manner described in clauses (A) or (B) shall be made by the Committee, whose determination shall be conclusive and binding in all respects on the Participant and the Company.

"Shares" means the shares of common stock, $1.00 par value, of the Company.

"Subsidiary" means (i) a corporation, association or other business entity of which 50% or more of the total combined voting power of all classes of capital stock is owned, directly or indirectly, by the Company or by one or more Subsidiaries of the Company or by the Company and one or more Subsidiaries of the Company, (ii) any partnership or limited liability company of which 50% or more of the capital and profit interests is owned, directly or indirectly, by the Company or by one or more Subsidiaries of the Company or by the Company and one or more Subsidiaries of the Company, or (iii) any other entity not described in clauses (i) or (ii) above of which 50% or more of the ownership and the power, pursuant to a written contract or agreement, to direct the policies and management or the financial and the other affairs thereof, are owned or controlled by the Company or by one or more Subsidiaries of the Company or by the Company and one or more Subsidiaries of the Company.

SECTION 3

ELIGIBILITY

3.1 Participants. Awards may be granted in the discretion of the Committee to officers, employees, directors and consultants of the Company and its Subsidiaries.

3.2 Non-Uniformity. Awards granted hereunder need not be uniform among eligible Participants and may reflect distinctions based on title, compensation, responsibility or any other factor the Committee deems appropriate.

SECTION 4

ADMINISTRATION

4.1 The Committee. The Plan will be administered by the Committee, which, to the extent deemed necessary by the Board, will consist of two or more persons who satisfy the requirements for a "non-employee director" under Rule 16b-3 promulgated under the 1934 Act and/or the requirements for an "outside director" under section 162(m) of the Code. The members of the Committee shall be appointed from time to time by, and shall serve at the pleasure of, the Board of Directors. In the absence of such appointment, the Board of Directors shall serve as the Committee and shall have all of the responsibilities, duties, and authority of the Committee set forth herein.

4.2 Authority of the Committee. The Committee shall have the exclusive authority to administer and construe the Plan in accordance with its provisions. The Committee's authority shall include, without limitation, the power to (a) determine persons eligible for Awards, (b) prescribe the terms and conditions of the Awards, (c) construe and interpret the Plan, the Awards and any Award Agreement, (d) adopt rules for the administration, interpretation and application of the Plan as are consistent therewith and (e) establish, interpret, amend or revoke any such rules. With respect to any Award that is intended to qualify as "performance-based compensation" within the meaning of section 162(m) of the Code, the Committee shall have no discretion to increase the amount of compensation that otherwise would be due upon attainment of a Performance Goal, although the Committee may have discretion to deny an Award or to adjust downward the compensation payable pursuant to an Award, as the Committee determines in its sole judgment. The Committee, in its sole discretion and on such terms and conditions as it may provide, may delegate all or any part of its authority and powers under the Plan to one or more officers of the Company to the extent permitted by law.

4.3 Decisions Binding. All determinations and decisions made by the Committee and any of its delegates pursuant to Section 4.2 shall be final, conclusive and binding on all persons, and shall be given the maximum deference permitted by law.

SECTION 5

SHARES SUBJECT TO THE PLAN

5.1 Number of Shares. Subject to adjustment as provided in Section 5.3, the total number of Shares available for grant under the Plan shall not exceed 600,000 Shares. The Shares available for issuance under the Plan shall be authorized but unissued Shares of the Company.

5.2 Lapsed Awards. Unless determined otherwise by the Committee, Shares related to Awards that are forfeited, cancelled, terminated or expire unexercised, shall be available for grant under the Plan. Shares that are tendered by a Participant to the Company in connection with the exercise of an Award, withheld from issuance in connection with a Participant's payment of tax withholding liability, or settled in such other manner so that a portion or all of the Shares included in an Award are not issued to a Participant shall not be available for grant under the Plan.

5.3 Adjustments in Awards and Authorized Shares. In the event of a stock dividend or stock split, the number of Shares subject to the Plan, outstanding Awards and the numerical amounts set forth in Sections 5.1, 6.1, 7.1 and 8.1 shall automatically be adjusted to prevent the dilution or diminution of such Awards, except to the extent directed otherwise by the Committee. In the event of a merger, reorganization, consolidation, recapitalization, separation, liquidation, combination or other similar change in the structure of the Company affecting the Shares, the Committee shall adjust the number and class of Shares which may be delivered under the Plan, the number, class and price of Shares subject to outstanding Awards, and the numerical limits of Sections 5.1, 6.1, 7.1 and 8.1 in such manner as the Committee shall determine to be advisable or appropriate to prevent the dilution or diminution of such Awards. Any such numerical limitations shall be subject to adjustment under this Section only to the extent such adjustment will not affect the status of any Award intended to qualify as "performance-based compensation" under section 162(m) of the Code or the ability to grant or the qualification of Incentive Stock Options under the Plan.

5.4 Restrictions on Transferability. The Committee may impose such restrictions on any Award, Award of Shares or Shares acquired pursuant to an Award as it deems advisable or appropriate, including, but not limited to, restrictions related to applicable Federal securities laws, the requirements of any national securities exchange or system upon which Shares are then listed or traded, and any blue sky or state securities laws.

SECTION 6

STOCK OPTIONS

6.1 Grant of Options. Subject to the terms and provisions of the Plan, Options may be granted to Participants at any time and from time to time as determined by the Committee. The Committee shall determine the number of Shares subject to each Option. The Committee may grant Incentive Stock Options, Nonqualified Stock Options, or any combination thereof. The maximum aggregate number of Shares underlying Options granted in any one calendar year to an individual Participant shall be 60,000.

6.2 Award Agreement. Each Option shall be evidenced by an Award Agreement that shall specify the Exercise Price, the expiration date of the Option, the number of Shares to which the Option pertains, whether the Option is intended to be an Incentive Stock Option or a Nonqualified Stock Option, any conditions on exercise of the Option and such other terms and conditions as the Committee shall determine, including terms regarding forfeiture of Awards or continued exercisability of Awards in the event of termination of employment by the Participant.

6.3 Exercise Price. The Exercise Price for each Option shall be determined by the Committee and shall be provided in each Award Agreement;provided,however, the Exercise Price for each Option may not be less than one hundred percent (100%) of the Fair Market Value of a Share on the Grant Date. In the case of an Incentive Stock Option, the Exercise Price shall be not less than one hundred ten percent (110%) of the Fair Market Value of a Share if the Participant (together with persons whose stock ownership is attributed to the Participant pursuant to section 424(d) of the Code) owns on the Grant Date stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries.

6.4 Expiration of Options. Except as provided in Section 6.7(c) regarding Incentive Stock Options, each Option shall terminate upon the earliest to occur of (i) the date(s) for termination of the Option set forth in the Award Agreement or (ii) the expiration of ten (10) years from the Grant Date. Subject to such limits, the Committee shall provide in each Award Agreement when each Option expires and becomes unexercisable. The Committee may not, after an Option is granted, extend the maximum term of the Option.

6.5 Exercisability of Options. Options granted under the Plan shall be exercisable, in whole or in part, at such times and be subject to such restrictions and conditions as the Committee shall determine. After an Option is granted, the Committee may accelerate or waive any condition constituting a substantial risk of forfeiture applicable to the Option.

6.6 Payment. Options shall be exercised by a Participant's delivery of a written notice of exercise to the Secretary of the Company (or its designee), setting forth the number of Shares with respect to which the Option is to be exercised, accompanied by full payment for the Shares. Upon the exercise of an Option, the Exercise Price shall be payable to the Company in full in cash or its equivalent. The Committee may permit exercise (a) by the Participant tendering previously acquired Shares having an aggregate Fair Market Value at the time of exercise equal to the total Exercise Price, (b) the Participant tendering a combination of cash and Shares equal to total Exercise Price (the Shares tendered being valued at Fair Market Value at the time of exercise), or (c) by any other means which the Committee determines to provide legal consideration for the Shares, and to be consistent with the purposes of the Plan. As soon as practicable after receipt of a written notification of exercise and full payment for the Shares purchased, the Company shall deliver to the Participant Share certificates (which may be in book entry form) representing such Shares. Until the issuance of the stock certificates, no right to vote or receive dividends or any other rights as a shareholder shall exist with respect to the Shares as to which the Option has been exercised. No adjustment will be made for a dividend or other rights for which a record date is established prior to the date the certificates are issued.

6.7 Certain Additional Provisions for Incentive Stock Options.

(a) Exercisability. The aggregate Fair Market Value (determined on the Grant Date(s)) of the Shares with respect to which Incentive Stock Options are exercisable for the first time by any Participant during any calendar year (under all plans of the Company, any parent and its Subsidiaries) shall not exceed $100,000. The portion of the Option which is in excess of the $100,000 limitation shall be treated as a Non-Qualified Option pursuant to Section 422(d)(1) of the Code.

(b) Company and Subsidiaries Only. Incentive Stock Options may be granted only to Participants who are officers or employees of the Company or a Subsidiary on the Grant Date.

(c) Expiration. No Incentive Stock Option may be exercised after the expiration of ten (10) years from the Grant Date. In the case of an Incentive Stock Option that is granted to a Participant who (together with persons whose stock ownership is attributed to the Participant pursuant to Section 424(d) of the Code) owns on the Grant Date stock possessing more than 10%

of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries, the term of such Incentive Stock Option shall be no more than five years from the Grant Date.

6.8 Restriction on Transfer. Except as otherwise determined by the Committee and set forth in the Award Agreement, no Option may be transferred, gifted, pledged, assigned, or otherwise alienated or hypothecated, voluntarily or involuntarily. Upon the death or Disability of a Participant, an Option may be exercised by the duly appointed personal representative of the deceased Participant or in the event of a Disability by the Participant or the duly appointed committee of the Disabled Participant to the extent the Option was exercisable on the date of death or the date of Disability and shall be exercisable for a period of six months from the date of death or the date of Disability. Upon Retirement of a Participant an Option may be exercised to the extent it was exercisable on the effective date of the Retirement and shall be exercisable for a period of six months from the effective date of such Retirement.

6.9 Repricing of Options. Without shareholder approval, (i) the Company will not reprice, replace or regrant an outstanding Option either in connection with the cancellation of such Option or by amending an Award Agreement to lower the exercise price of such Option, and (ii) the Company will not cancel outstanding Options in exchange for cash or other Awards.

6.10 Voting Rights. A Participant shall have no voting rights with respect to any Options granted hereunder.

SECTION 7

RESTRICTED STOCK AND RESTRICTED STOCK UNITS

7.1 Grant of Restricted Stock and Restricted Stock Units. Subject to the terms and provisions of the Plan, the Committee, at any time and from time to time, may grant Shares of Restricted Stock and/or Restricted Stock Units to Participants in such amounts as the Committee shall determine. The Committee shall determine the number of Shares and/or RSU's to be granted to each Participant and the time when each Award shall be granted. No more than 60,000 Shares of each of Restricted Stock and Shares underlying Restricted Stock Units may be granted to any individual Participant in any one calendar year.

7.2 Restricted Stock and RSU Agreements. Each Award of Restricted Stock and Restricted Stock Units shall be evidenced by an Award Agreement that shall specify the Period of Restriction, the number of Shares of Restricted Stock granted, the number of Shares subject to a Restricted Stock Unit, any applicable Performance Criteria, Performance Goal and Performance Cycle, and such other terms and conditions as the Committee shall determine, including terms regarding forfeiture of Awards in the event of termination of employment by the Participant or termination of the Participant's relationship with the Company as a director or consultant.

7.3 Transferability. Except as otherwise determined by the Committee and set forth in the Award Agreement, Shares of Restricted Stock and Restricted Stock Units including Shares underlying RSU's may not be sold, transferred, gifted, bequeathed, pledged, assigned, or otherwise alienated or hypothecated, voluntarily or involuntarily, until the end of the applicable Period of Restriction and the satisfaction, in whole or in part, of any applicable Performance Goals within the applicable Performance Cycle. Except as otherwise determined by the Committee and set forth in the Award Agreement, in the event of the death, Disability or Retirement of a Participant, all unvested Restricted Stock and unvested RSU's shall not vest on the date of death or Disability or the effective date of Retirement. Without shareholder approval, the Company will not, except as otherwise provided for in the Plan, repurchase outstanding unvested Restricted Stock or unvested RSU's in exchange for cash or accelerate the vesting of outstanding unvested Shares of Restricted Stock or RSU's. The Committee

may include a legend on the certificates representing Restricted Stock or RSU's to give appropriate notice of such restrictions.

7.4 Other Restrictions. The Committee may impose such other restrictions on Shares of Restricted Stock and Restricted Stock Units (including Shares underlying RSU's) as it may deem advisable or appropriate in accordance with this Section 7.4.

(a) General Restrictions. The Committee may set one or more restrictions based upon (a) the achievement of specific Performance Goals, (b) applicable Federal or state securities laws, (c) time-based restrictions, or (d) any other basis determined by the Committee.

(b) Section 162(m) Performance Restrictions. For purposes of qualifying grants of Restricted Stock and/or RSU's as "performance-based compensation" under Section 162(m) of the Code, the Committee, in its sole discretion, may set restrictions based upon the achievement of Performance Goals. The Performance Goals shall be set by the Committee on or before the latest date permissible to enable the Restricted Stock and/or RSU's to qualify as "performance-based compensation" under section 162(m) of the Code. In granting Restricted Stock and/or RSU's that are intended to qualify under section 162(m) of the Code, the Committee shall follow any procedures determined by it in its sole discretion from time to time to be necessary, advisable or appropriate to ensure qualification of the Restricted Stock and/or RSU's under section 162(m) of the Code.

(c) Retention of Certificates. To the extent deemed appropriate by the Committee, the Company shall retain the certificates representing Shares of Restricted Stock and/or RSU's in the Company's possession until such time as all conditions and restrictions applicable to such Shares have been satisfied or lapse.

7.5 Removal of Restrictions. After the end of the Period of Restriction, the Shares shall be freely transferable by the Participant, subject to any other restrictions on transfer which may apply to such Shares. Notwithstanding the foregoing, the Committee shall not act in a manner that would cause a grant that is intended to be "performance-based compensation" under Code Section 162(m) to fail to be performance-based.

7.6 Voting Rights. Except as otherwise determined by the Committee and set forth in the Award Agreement, Participants holding (a) Shares of Restricted Stock shall have voting rights during the Period of Restriction and (b) Restricted Stock Units shall not have voting rights during the Period of Restriction.

7.7 Dividends and Other Distributions. Except as otherwise determined by the Committee and set forth in the Award Agreement, Participants holding (a) Shares of Restricted Stock shall be entitled to receive all dividends and other distributions paid with respect to the Shares during the Period of Restriction and (b) RSU's shall not be entitled to receive any dividends or other distributions paid with respect to the underlying Shares during the Period of Restriction.

SECTION 8

PERFORMANCE-BASED AWARDS

8.1 Performance-Based Awards. Participants selected by the Committee may be granted one or more Performance Awards in the form of Options, Restricted Stock, Restricted Stock Units or Performance Share Awards payable upon the attainment of Performance Goals that are established by the Committee and related to one or more of the Performance Criteria, in each case on a specified date or dates or over a Performance Cycle determined by the Committee. A Performance Cycle shall be at least one year. The Committee in its sole discretion shall determine whether an Award is to qualify as "performance based compensation" under Section 162(m) of the Code. The Committee in its sole discretion shall determine Awards that are based on Performance Goals but are not intended to

quality as "performance based compensation" under Section 162(m). The Committee shall define the manner of calculating the Performance Criteria it selects to use for any Performance Cycle. Depending on the Performance Criteria used to establish such Performance Goals, the Performance Goals may be expressed in terms of overall Company performance or the performance of an individual. The Committee, in its discretion, may adjust or modify the calculation of Performance Goals for such Performance Cycle in order to prevent the dilution or enlargement of the rights of an individual (i) in the event of, or in anticipation of, any unusual or extraordinary corporate item, transaction, event or development, (ii) in recognition of, or in anticipation of, any other unusual or nonrecurring events affecting the Company, or the financial statements of the Company, or (iii) in response to, or in anticipation of, changes in applicable laws, regulations, accounting principles, or business conditions;provided however, that the Committee may not exercise such discretion in a manner that would increase the Performance-Based Award granted to a Participant. Each Performance-Based Award shall comply with the provisions set forth below. Performance Awards shall be paid in Shares.

(a) Grant of Performance-Based Awards. With respect to each Performance-Based Award granted to a Participant, if intended by the Committee to qualify as "performance based compensation" under Section 162(m) of the Code, the Committee shall select, within the first 90 days of a Performance Cycle the Performance Criteria for such grant, and the Performance Goals with respect to each Performance Criterion (including a threshold level of performance below which no amount will become payable with respect to such Award). Each Performance-Based Award will specify the number of shares issuable, or the formula for determining the number of shares issuable, upon achievement of the various applicable performance targets. The Performance Criteria established by the Committee may be (but need not be) different for each Performance Cycle and different Performance Goals may be applicable to Performance-Based Awards to different Participants.

(b) Payment of Performance-Based Awards. Following the completion of a Performance Cycle, the Committee shall meet to review and certify in writing whether, and to what extent, the Performance Goals for the Performance Cycle have been achieved and, if so, to also calculate and certify in writing the amount of the Performance-Based Awards earned for the Performance Cycle. The Committee shall then determine the actual size of each Participant's Performance-Based Award, and, in doing so, may reduce or eliminate the amount of the Performance-Based Award for a Participant if, in its sole judgment, such reduction or elimination is appropriate.

(c) Maximum Award Payable. The maximum Performance-Based Award issuable to any one Participant under the Plan for a Performance Cycle is 60,000 Shares (subject to adjustment as provided in Section 5.3 hereof).

SECTION 9

AMENDMENT, TERMINATION, AND DURATION

9.1 Amendment, Suspension, or Termination. The Board, in its sole discretion, may amend, suspend or terminate the Plan, or any part thereof, at any time and for any reason;provided,however, that if and to the extent required by law or to maintain the Plan's compliance with the Code, the rules of any national securities exchange (if applicable), or any other applicable law, any such amendment shall be subject to shareholder approval; andfurther provided, that without shareholder approval, no amendment shall permit the repricing, replacing or regranting of an Option in connection with the cancellation of such Option or by amending an Award Agreement to lower the exercise price of such Option or the cancellation of any Award in exchange for cash. The amendment, suspension or termination of the Plan shall not, without the consent of the Participant, alter or impair any rights or obligations under any Award theretofore granted to such Participant. No Award may be granted during any period of suspension or after termination of the Plan.

9.2 Duration of the Plan. The Plan shall become effective in accordance with Section 1.1, and subject to Section 9.1 shall remain in effect until the tenth anniversary of the effective date of the Plan.

SECTION 10

TAX WITHHOLDING

10.1 Withholding Requirements. Prior to the delivery of any Shares pursuant to an Award (or the exercise thereof), the Company shall have the power and the right to deduct or withhold from any amounts due to the Participant from the Company, or require a Participant to remit to the Company, an amount sufficient to satisfy Federal, state and local taxes (including the Participant's FICA obligation) required to be withheld with respect to such Award (or the exercise or vesting thereof).

10.2 Withholding Arrangements. The Committee, pursuant to such procedures as it may specify from time to time, may permit a Participant to satisfy such tax withholding obligation, in whole or in part, by (a) electing to have the Company withhold otherwise deliverable Shares, or (b) delivering to the Company Shares then owned by the Participant. The amount of the withholding requirement shall be deemed to include any amount that the Committee agrees may be withheld at the time any such election is made, not to exceed the amount determined by using the maximum federal, state or local marginal income tax rates applicable to the Participant with respect to the Award on the date that the amount of tax to be withheld is to be determined. The Fair Market Value of the Shares to be withheld or delivered shall be determined as of the date that the taxes are required to be withheld.

SECTION 11

CHANGE IN CONTROL

11.1 Change in Control. For purposes of the Plan, a Change in Control means any of the following:

(a) the acquisition (other than from the Company) in one or more transactions by any person (as such term is used in Section 13(d) of the 1934 Act) of the beneficial ownership (within the meaning of Rule 13d-3 under the 1934 Act) of 25% or more of (i) the then outstanding Shares or (ii) the combined voting power of the then outstanding securities of the Company entitled to vote generally in the election of directors (the "Company Voting Stock"),provided however the provision of this Section 11.1(a) is not applicable to acquisitions made individually, or as a group by Fredric H. Gould, Matthew J. Gould and Jeffrey A. Gould, and their respective spouses, lineal descendants and affiliates;

(b) individuals who, as of the date of the Award, constitute the Board (the "Incumbent Board") cease for any reason to constitute at least a majority of the Board;provided,however, that any individual becoming a director subsequent to the date of such Award whose election, or nomination for election by the Company's stockholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of either an actual or threatened election contest (as such terms are used in the Rules of Regulation 14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board;

(c) the closing of a sale or other conveyance of all or substantially all of the assets of the Company; or

(d) the effective time of any merger, share exchange, consolidation, or other business combination involving the Company if immediately after such transaction persons who hold a majority of the outstanding voting securities entitled to vote generally in the election of directors

of the surviving entity (or the entity owning 100% of such surviving entity) are not persons who, immediately prior to such transaction, held the Company's voting Shares.

11.2 Effect of Change of Control. On the effective date of any Change in Control, unless the applicable Award Agreement provides otherwise: (i) in the case of an Option, each such outstanding Option shall become exercisable in full in respect of the aggregate number of Shares covered thereby; and (ii) in the case of Restricted Stock, Restricted Stock Units and Performance Share Awards, the Restriction Period applicable to each such Award shall be deemed to have expired. Notwithstanding the foregoing, unless otherwise provided in the applicable Award Agreement, the Committee may, in its discretion, determine that any or all outstanding Awards of any or all types granted pursuant to the Plan will not become exercisable on an accelerated basis nor will the Restriction Period expire in connection with a Change of Control if effective provision has been made for the taking of such action which, in the opinion of the Committee, is equitable and appropriate to substitute a new Award for such Award or for the assumption of such Award and to make such new or assumed Award, as nearly as may be practicable, equivalent to the old Award (before giving effect to any acceleration of the exercisability or the expiration of the Restriction Period), taking into account, to the extent applicable, the kind and amount of securities, cash, or other assets into or for which the Shares may be changed, converted, or exchanged in connection with such Change of Control.

SECTION 12

MISCELLANEOUS

12.1 Deferrals. To the extent consistent with the requirements of section 409A of the Code, the Committee may provide in an Award Agreement or another document that a Participant is permitted to defer receipt of the delivery of Shares that would otherwise be due to such Participant under an Award. Any such deferral shall be subject to such rules and procedures as shall be determined by the Committee.

12.2 Termination for Cause. If a Participant's employment or relationship with the Company or a Subsidiary (as a director or consultant) shall be terminated for cause by the Company or such Subsidiary during the Restriction Period or prior to the exercise of any Option (for these purposes, cause shall have the meaning ascribed thereto in any employment agreement to which such Participant is a party or, in the absence thereof, shall include, but not be limited to, insubordination, dishonesty, incompetence, moral turpitude, the refusal to perform his duties and responsibilities for any reason (other than illness or incapacity) and other misconduct of any kind), then, (i) all Options shall immediately terminate and (ii) such Participant's rights to all Restricted Stock, RSU's and Performance Share Awards shall be forfeited immediately.

12.3 Section 162(m). Notwithstanding anything to the contrary herein or in an Award Agreement, an Award that is intended to qualify as "performance based compensation" under Section 162(m) of the Code, shall not vest in whole or in part in the event of the Participant's Retirement, involuntary termination or if the Participant terminates his or her relationship with the Company, except to the extent (a) the Performance Goal's shall be achieved within the Performance Cycle or (b) otherwise permitted under Section 162(m) of the Code.

12.4 No Effect on Employment or Service. Nothing in the Plan or in any Award, and no action of the Committee shall confer or be construed to confer on any Participant any right to continue in the employ or service of the Company or any Subsidiary or shall interfere with or limit in any way the right of the Company or any Subsidiary to terminate any Participant's employment or service at any time, with or without cause. Employment with the Company or any Subsidiary is on an at-will basis only, unless otherwise provided by an applicable employment or service agreement between the Participant and the Company or any Subsidiary, as the case may be.

12.5 Successors. All obligations of the Company under the Plan, with respect to Awards granted hereunder, shall be binding on any successor to the Company, whether the existence of such successor is the result of a direct or indirect merger, consolidation or otherwise, or the purchase of all or substantially all of the business or assets of the Company.

12.6 No Rights as Shareholder. Except to the limited extent provided in Sections 7.6 and 7.7, no Participant (nor any beneficiary thereof) shall have any of the rights or privileges of a shareholder of the Company with respect to any Shares issuable pursuant to an Award (or the exercise or vesting thereof), unless and until certificates representing such Shares shall have been issued, recorded on the records of the Company or its transfer agents or registrars, and delivered to the Participant (or his or her beneficiary).

12.7 Uncertificated Shares. To the extent that the Plan provides for issuance of certificates to reflect the issuance or transfer of Shares, the issuance or transfer of such Shares may be effected on a noncertificated basis or book entry basis, to the extent not prohibited by applicable law or the rules of any stock exchange.

12.8 Fractional Shares. No fractional Shares shall be issued or delivered pursuant to the Plan or any Award. The Committee shall determine whether cash, or Awards, or other property shall be issued or paid in lieu of fractional Shares or whether such fractional Shares or any rights thereto shall be forfeited or otherwise eliminated.

12.9 Severability. In the event any provision of the Plan shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of the Plan, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

12.10 Requirements of Law. The grant of Awards and the issuance of Shares under the Plan shall be subject to all applicable laws, rules and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required from time to time.

12.11 Securities Law Compliance. To the extent any provision of the Plan, Award Agreement or action by the Committee fails to comply with any applicable federal or state securities law, it shall be deemed null and void, to the extent permitted by law and deemed advisable or appropriate by the Committee.

12.12 Governing Law. The Plan and all Award Agreements shall be construed in accordance with and governed by the laws of the State of Maryland.

12.13 Captions. Captions are provided herein for convenience of reference only, and shall not serve as a basis for interpretation or construction of the Plan.

| 14475 ONE LIBERTY PROPERTIES, INC. PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS JUNE 12, 2012 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints SIMEON BRINBERG, MARK H. LUNDY AND ASHER GAFFNEY, as Proxies each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side, all the shares of Common Stock, $1.00 par value per share, of One Liberty Properties, Inc. held of record by the undersigned on April 17, 2012 at the Annual Meeting of Stockholders to be held on June 12, 2012 or any adjournments thereof. (TO BE SIGNED ON REVERSE SIDE)

|

| ANNUAL MEETING OF STOCKHOLDERS OF ONE LIBERTY PROPERTIES, INC. June 12, 2012 NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIAL: The Notice of Meeting, proxy statement and proxy card are available at http://onelibertyproperties.com//files/client_files/325/523/2012annualmeetingmaterials.pdf Please sign, date and mail your proxy card in the envelope provided as soon as possible. Signature of Stockholder Date: Signature of Stockholder Date: Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. 1. Election of three Directors: O Joseph A. DeLuca O Fredric H. Gould O Eugene I. Zuriff 2. To approve the 2012 Incentive Plan. 3. Appointment of Ernst & Young LLP as independent registered public accounting firm for the year ending December 31, 2012. 4. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. This Proxy, when properly executed, will be voted in the manner directed by you. If no direction is made, this Proxy will be voted FOR all nominees and FOR proposals 2 and 3. You are encouraged to specify your choices by marking the appropriate boxes, but you need not mark any boxes if you wish to vote in accordance with the Board of Directors' recommendation. The Proxies cannot vote your shares of common stock unless you sign and return this card. FOR AGAINST ABSTAIN FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (See instructions below) NOMINEES: PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x Please detach along perforated line and mail in the envelope provided. 20333000000000000000 6 061212 INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:

|

37